01

TCVC | Fund Strategic Planning

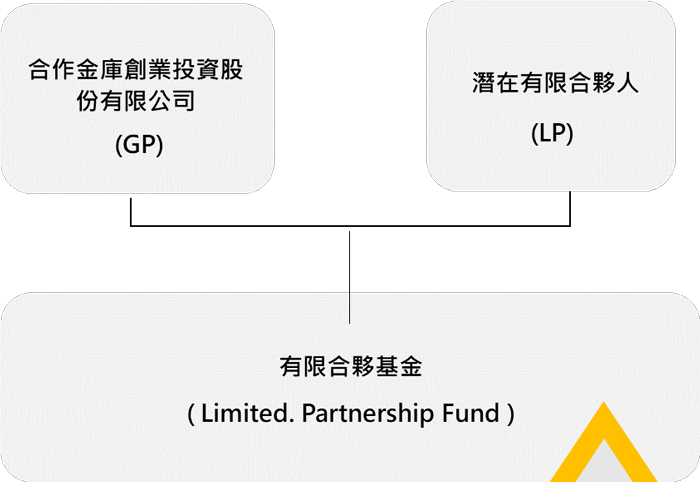

TCVC is committed to developing and participating in limited partnership funds, expanding business connection opportunities, and seeking more resources for existing investment targets. Since its establishment in 2015, we have invested in a variety of professional funds as a general partner (GP) or limited partner (LP), such as: Aggregation Limited Partnership, Salary Sensing Capital Limited Partnership or China Development Two Biomedical Venture Capital Limited Partnership…etc.Combining the successful experience of participating in the Ministry of Finance's "Public Equity Venture Capital and Ten-Billion Revitalization" in the past, we will plan to create a number of smaller limited partnership funds with shorter durations to target higher liquidity public offerings or private placement stages. Invest to continue and expand asset management business capabilities, fill long-term investment momentum, and enhance competitiveness and performance trajectory among peers.

02

Cooperation Pattern | Cooperation – General Partner, CO – GP

TCVC adheres to the spirit of flexibility, initiative and innovation, adheres to excellent and rigorous investment decision-making processes, risk control, legal compliance and review mechanisms, and understands operational and investment risks as clearly as possible, so that our participants can trust and every company can Invested companies feel at ease.

Why cooperate with us?

For "Industry People"

- TCVC is one of the eight major public equity banks in Taiwan and has excellent group resources that can exert synergistic effects.

- We look for cutting-edge and developing technologies that can meet enterprises’ needs for technological innovation or services, and provide mutual introductions and resource matchmaking.

- Co-invest, improve the company's equity structure, and introduce professional financial investors.

- Enter various industries and understand the trends among different industries.

For "Investors"

- Professional managers lead the way, conduct prudent evaluation and investment, and have a complete investment and exit process system.

- Aiming for rapid recovery within 1 - 3 years, accelerate capital flow and create high-leverage profits.

- Recommend case sources, expand access to high-quality targets, and share investment risks to increase the probability of successful investment.

Introduction the investment until exit process

01

Case Source Establishment

02

Investment Evaluation

Investment Review and Decision-Making

The investment evaluation process is carried out in accordance with the investment evaluation methods and procedures established by TCVC.

Investment will be made after the investment review is approved by TCVC Investment Review Committee.

Major investments are made after resolution by the Limited Partner Advisory Committee.

03

Post-Investment Management

Management Mechanism

The limited partnership assets are managed by Taiwan Cooperative Bank.

Provide quarterly investment reports every quarter.

Fund Finance Committee (Deloitte & Touche) Accountant Visa.

Investment cases are subject to audit and inspection by Taiwan Cooperative Financial Holding and Financial Supervisory Commission.

04

Profit Disposal

Earnings Distribution

The investment principal will be returned first after the disposition.

Disposal and recovery funds will be given priority to return partners’ principal, and ROI thresholds will be set to encourage general partners to create performance.

03

Introduction to Past Participation Cases

JC Capital/ Wisdom Capital Limited Partnership

- Participation method: General partner (JC Capital Management)

- Duration: July, 20th 2019 ~ June 1th 2028

- Actual investment amount received: $NT 653,853,800

- Main investment projects: Semiconductor supply chain, EV& AIoT and GreenTech green energy.

Mesh Cooperative Ventures/ Mesh Cooperative Ventures Fund LP

- Participation method: General partner & Limited partner (Mesh management)

- Duration: July, 29th 2022 ~ July, 28th 2027

- Investment amount: $NT 731,052,634

- Main investment projects: AI, electronics, automobiles, and Internet of Things (IoT) fields